The Artificially Intelligent Boardroom

We recently published a paper on SSRN (“The Artificially Intelligent Boardroom”) that examines how artificial intelligence can impact board processes, practices, and dynamics.

Artificial intelligence has the potential to significantly transform many aspects of corporate activity, including decision making, productivity, customer experience, and content creation. The impact on boardrooms is likely to be significant—but perhaps in different ways than is commonly recognized.

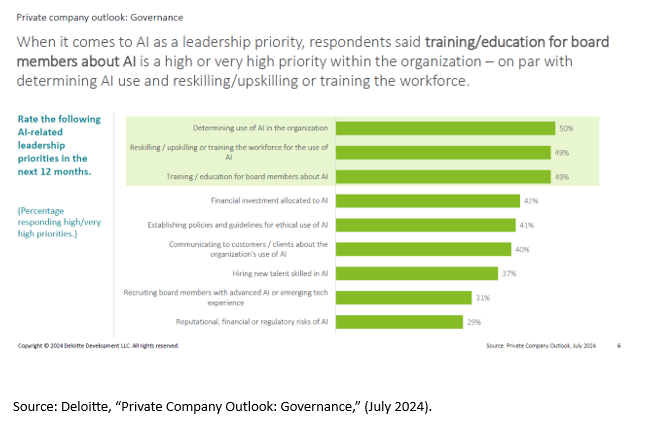

Boards are aware of the enormous potential of AI. According to one survey, corporate leaders rank “increasing the use of AI across the organization” above all other priorities for the coming year, including such staples as revenue growth, productivity, margin improvement, and strategic opportunities. Boards have also been busy determining the organizational use of AI, its competitive impact, level of financial investment, training, guidelines, and reputational risk (see Exhibit 1).

Much less consideration, however, has been paid to the ways in which the application of artificial intelligence technology can reshape the operations and practices of the board itself, with the prospect of substantially improving corporate governance quality. Four areas in particular are poised for impact, including:

- How boards function

- How boards process information

- How boards interact with management, and management with boards

- How board advisors contribute

While AI has the potential to dramatically alter board practices, its adoption will also raise important questions about how to maintain the line between board and managerial responsibilities, and how expectations on each side will change.

Traditional View of Governance

Effective corporate governance relies on the separation of managerial and board responsibilities. Management runs the corporation, and the board oversees management to ensure its actions are in the interest of shareholders. In the absence of red flags, the board is permitted to rely on information provided by management to inform its decisions and carry out this oversight role. Because the board is not involved in day-to-day operations, an information asymmetry exists between what the board and management know about the organization. In some situations, this information asymmetry can be severe.

Current board practices reflect how boards operate under this constraint. Management presents information through regularly scheduled board meetings, committee meetings, and ad hoc communications. Boards respond to this information by asking questions and requesting additional information as needed. For some matters, the board will contract with a third-party advisor (consultant, banker, auditor, etc.) to provide market information or an external perspective on best practices. Under this arrangement—and if the board makes decisions with due deliberation and without conflict of interests—, it will have satisfied its fiduciary duty to shareholders.

Nevertheless, plenty of examples exist that point to the insufficiency of this arrangement. Many boards have been woefully uninformed about the financial, operating, and strategic risk of management decisions—as borne out through repeated examples of corporate meltdowns over the years. Boards have erred in situations of CEO selection, financial reporting, product liability, compensation setting, and reputation management. Twenty years ago, Deloitte published a seminal study underscoring a surprising disconnect between the information board members say are important drivers of corporate performance and the information and metrics boards actually receive to monitor this performance. While the proximate cause of the failure identified in the study was the choice of key performance indicators, the fundamental problem is an issue of information flow between management and the board.

Impact of AI on Governance

Artificial intelligence has the potential to change this dynamic. First, artificial intelligence offers to increase the volume, type, and quality of information available to management and boards. By making this information readily available, it reduces the information asymmetry between management and directors. Board members are much less likely to be “in the dark” about the operating and governance realities of their companies as technology makes it easier for them to search and synthesize public and private information made available to them through AI board tools. Second, AI increases the burden on both parties to review, synthesize, and analyze information prior to board meetings. Managers and directors can expect to spend substantially more time on meeting preparation, because the quantity of available knowledge is substantially greater. Elementary information that was previously reviewed during meetings will be expected to be analyzed and digested prior to the meeting. Third, artificial intelligence will allow for the supplementation—and in some cases, replacement—of information provided by third-party advisors and consultants. Furthermore, AI will increase the breadth of analysis available to the board, coupling the retrospective review of mostly historical data (prevalent today) with more powerful tools for predictive and trend analysis. These tools will allow boards to be more proactive and less reactive.

At the same time, the adoption of artificial intelligence in the boardroom will raise significant questions. The most important of these is the impact it will have on expectations for board contribution. Current governance practice generally places board members in a responsive position to management and the information it provides (the type, structure, and framing of this information). With AI, directors will have access to exponentially deeper information that supplements and goes beyond management-prepared board materials. AI tools will be able to prompt board members with key questions based on the agenda and possibly suggest the types of analysis that would be helpful for reaching a decision, such as benchmarking against competitors or linking data to reveal trends. Expectations for a director’s diligence in reviewing and preparing this information will be exponentially higher, and the quality of questions, challenges, and insights will also be expected to be correspondingly higher. On the other hand, executives will have the opportunity to dry-run their presentations against an AI interface that can prepare them for the questions they might expect to receive. By (confidentially) asking, “What are the greatest weaknesses in the arguments I have made?” and “What are potential flaws in my proposal?” executives should be better positioned to anticipate and respond to challenges raised by their boards.

A related question is the limit that should be placed on the information boards will have access to. In theory, granting directors access to an AI interface that itself has full access to all data in the corporate data repository means that directors will have practically no limit (relative to management) to the information they can access. From a legal perspective, however, boards might not want unrestricted access. Where and how to draw the line (and what information is ring-fenced) will require careful thinking. Boards and their counsel will have to determine how boards rely on AI analysis conducted by an individual director that was not provided by management. What impact this has on fiduciary expectations is unknown.

Furthermore, the protection of this data from cybersecurity and hacking threats will be a central consideration of how AI is adopted and governed. Given the sensitivity and proprietary nature of the data fed into AI models, significant steps will need to be taken to protect against unauthorized access. The risk will be higher for large corporations with multiple connection points to suppliers, customers, and employees.

Application to Governance Functions

Artificial intelligence also has the potential to alter the process by which boards fulfill specific governance obligations.

- Strategy. AI will allow richer access for boards and management in areas of scenario planning, testing assumptions, identifying risk, and prioritizing investment. Some of the work that was previously outsourced to strategy consultants will be available in-house, at lower cost and turnaround time. Boards will be able to compare the recommendations of AI against those of external strategy consultants.

- Compensation. The compensation committee will have access to analytical and benchmarking tools to evaluate compensation design against a more flexible set of peer institutions. Rather than waiting for external consultants to re-run analyses against pre-designated peer groups, boards and their advisors will be able to analyze sensitivity of pay to peer groups selection in real-time, predict proxy advisor recommendations, and consider tax and legal implications. This is especially plausible because public compensation data is already available in electronic form.

- Human Capital Management. AI tools will allow the board to perform advanced analytics on information in the company’s human capital management databases, apply pattern recognition to workforce data, identify skills gaps, and perform long-range workforce and diversity forecasting.

- Audit. The audit committee will have access to surveillance tools that look for internal control weakness and identify potential fraud. The external auditor, too, will have access to AI tools that can provide reasonableness checks on a broader scope of transactions. The audit committee will have to consider the risks and ethical considerations of automating the audit process, and how and when to apply human judgment to a more automated process.

- Legal. AI technology will allow for the monitoring and summarization of emerging legal and regulatory developments, including lawsuits and enforcement actions at other corporations that might have bearing on the company’s activities. Directors will have access to alternative legal opinions and cases in real-time.

- Board evaluations. AI can also be leveraged to track, review, and analyze board effectiveness, at both the individual and board level. AI-driven coaching and advisory tools will be able to replace work that is currently performed through survey forms, helping boards to measure their engagement, evaluate how they allocate their time and focus, and determine whether they are primarily reactive or proactive.

No doubt, a significant portion of this analysis will supplant or supplement work currently performed by paid advisors.

Additional Benefits and Risks

As artificial intelligence is introduced to the boardroom, boards will be able to conduct real-time analysis—whether led by management, advisors, or board members themselves. Alternative or supplemental information that is missing can be searched for and brought in during the discussion. This will increase the cadence of meetings and reduce delays to decision-making, as less time is needed to wait on analysis conducted “between meetings.” It will also allow for more robust scenario planning and potentially richer suggestions. Management will benefit from more sophisticated meeting preparation. They will be able to run simulation tests of their own presentations and ask AI to ask tough questions.

At the same time, the application of this technology to the boardroom poses potential risks and challenges. One challenge is overcoming the wedge created between companies operating in an environment where competitors are predominantly private versus publicly traded. Public companies are subject to extensive disclosure requirements, and information about their operations and performance is publicly available. Private companies, on the other hand, operate with fewer disclosure requirements. Depending on their competitive set, companies will have to think differently about the information they feed into models and how to perform benchmarking analysis using public, audited data versus privately sourced data that may carry inaccuracies or biases.

Another major risk is the substantial number of errors generated by current AI models. AI models come with inherent biases, the quality and availability of data can vary, and competitive intelligence may introduce additional complexities. AI makes computational and mathematical errors. It also does not always say “I don’t know” to questions it might not know an answer to, grabbing available data to answer a question when the data might not be directly applicable. Boards and managers will need to learn how to fact check output before relying on it. This will require deeper (human) familiarity with the data. Boards will need to educated on these and other limitations of this technology.

AI monitoring will also likely generate a high number of red flags related to internal and external practices or threats. Boards will have to weigh materiality risk in determining which risks require additional investigation, how to prioritize them, and how not to create a paper trail that increases the board’s own liability. With the cost of analysis dramatically reduced, board members will have to train themselves not to fall victim to excessive analysis (“analysis paralysis”), but keep their effort focused on practical and efficient outcomes that benefit the corporation and its stakeholders. To this end, board and committee chairs will need to exhibit stronger leadership skills to manage meeting dynamics effectively and ensure that analyses and conversations remain on track.

Why This Matters

- Artificial intelligence technology offers the potential to transform many corporate practices, including corporate governance. With the adoption of this technology in the boardroom, directors will essentially have a real-time advisor available at hand. This will reduce information asymmetries between the board and management, allowing directors to be more proactive in identifying matters requiring attention. It also has the potential to significantly increase the time requirements of director and committee membership, as directors review, test, and synthesize information made available to them. How will AI change board processes, practices, and dynamics? Are current directors equipped to adapt to this change? What training, resources, advice, and counsel will be needed to navigate it? How can directors embrace a larger role in analysis and decision making without increasing their personal liability?

- AI, too, will offer benefits to managers in their interaction with boards. Managers will effectively have a real-time board member by their side, who can help them prepare for meetings, identify issues, and anticipate questions—with AI able to pose both elementary and sophisticated questions. Directors who do not contribute sufficiently will likely become more exposed. How will managers react to a governance setting where boards have more access and transparency into internal operations? How will directors respond to a setting where technology interfaces can replicate many of their insights? Will AI in the boardroom lead to a general improvement in governance quality, or will failures of human and technological judgment continue to produce the same frequency of breakdowns that we witness today?

- When do directors have so much access to information and analysis that they are close to becoming managers? Given the breadth and depth of analysis available through AI, who will prevent directors from asking questions that “cross the line”?

Link to SSRN: https://ssrn.com/abstract=5182306

Exhibit 1: Organizational Priorities for Artificial Intelligence

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release